Wealth Management

Wealth management refers to customer-centric, company design a comprehensive financial plan and then through the provision of cash, credit, insurance, portfolio and a series of financial services to manage the customer asset,liabilities as well as liquidity in order to meet the different stages of the financial demand of customers to help customers to achieve the risk reduction and achieve the purpose of wealth preservation and appreciation. Wealth management includes cash savings and management, debt management, personal risk management, insurance plans, portfolio management, retirement plans and heritage arrangements.

According to McKinsey & Bain's global private wealth distribution and growth forecast, global wealth distribution and investment gradually shift to "New World" (including the Asia-Pacific, excluding Japan), Eastern Europe, the Middle East and Africa, which refer to Asia-Pacific region will be more than North America in 2017 and become the largest area of private wealth.

Next 10 years, China's high net worth of investment philosophy trends are as follows:

1. From "wealth appreciation" to "wealth preservation";

2. From " wealth creation " to " wealth inheritance ";

3. From "domestic investment" to "overseas investment";

4. From "singularity" to "diversification".

In order to meet the need of China's high net worth families for wealth management, APAC Synergy will combine the needs of high net worth families and advanced foreign management experience, and mainly through offshore wealth, decentralized investment, foreign insurance and family trust to achieve personal wealth’s preservation and appreciation.

Overseas Property Investment

The word "blessing" and "rich" in Chinese characters can prove that we have loved the real estate since ancient times.

Economist Pierre (21st Century Capita) has clearly shown that the return on capital (r, wealth return rate) is greater than the economic growth rate (g), in 21st century, with the global economic slowdown , the difference between r and g will continue to expand, which means as long as the wealth will be more and more rich, this trend will exacerbate inequality due to wealth is only concentrated in the hands of a small number of people.

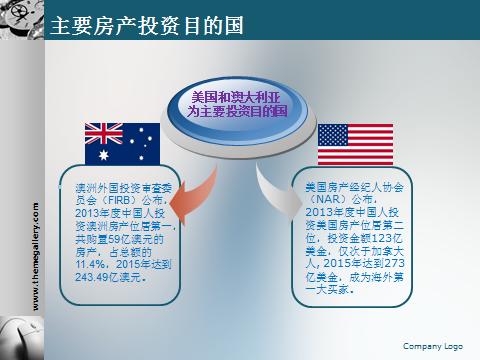

February 2017 by Housing World released the "2016 Chinese overseas buyers trend report" shows that in Chinese overseas buyers’ target countries, the United States still is the China's high net worth families’ overseas home buyers favorite country, accounts for up to 27.7%. The other top four countries were Australia (19.37%), Canada (13.89%), and Japan (13.16%). “Asset allocation, risk diversification" has become the main purpose of high net worth overseas buyers, this consideration accounting for up to 51.8%; followed by self-occupied, accounting for about 38.3%, and the percentage of future immigrants to buy house abroad get about 7.8%. In 2017, with the appreciation of US dollar, Australia's stable economy, the Japanese 2020 Olympic Games and other factors, the people are bound to be more impatient to buy overseas real estate.

Based on the above trend analysis, APAC Synergy would work with well-known real estate companies from the United States and Australia to provide great investment projects for China’s high net worth people.

Overseas Insurance

As the representative of the Chinese real economy, the real estate industry has fell into the adjustment stage, the implementation of the supply side reform and the sharp fluctuations in the RMB exchange rate, China's high net worth families’ domestic investment channels have been further reduced. As the representative of the overseas insurance products, Hong Kong insurance has become the new love for high net worth families.

Hong Kong insurance, for example, in the first half of 2016, the trend of mainlanders’ buying Hong Kong insurance get a new high, which achieved 30.1 billion HKD, an increase of 116%. The most popular insurance policies are lifetime major disease insurance and lifetime savings bonus insurance.

Six advantages of insurance in wealth management

One:

The assurance of wealth Distribution

Two:

The assurance of long-term security with less future generations’ vulnerrability

Three:

Inheritance tax and fees are almost zero.

Four:

Asset isolation and debt relief.

Five:

Confidentiality

Six:

Timeliness

According to the actual demand of customer, APAC Synergy can provide advice on oversea insurance for high net worth clients. The current products are mainly from Hong Kong, the United States, Australia and Singapore.

Overseas Prudent Financial Product

APAC Synergy – Kehlmann Capital Fund(Prudent)

Type of Fund | Start from | Lock-in period | ROI per annum | Payment | Fund Raising Period |

Fixed income | $ 500,000 | 12 months | 10% | Quarterly | 07/2017-07/2018 |

Australian Fund Manager License: AFSL 337968

Investment Strategy: Investment in short-medium term Australian property development priority loans (3-24 months)

Property types: Including but not limited to residential, commercial, agricultural, land and development.

Investment creditor loan ratio (LVR): less than 70%

Fund management annual fee: 2%

Annum net income: 8%

Exit mechanism: Withdrawal on expiry or continuous rolling, enjoy high returns;

Early withdrawal incurs 1.5% penalty.

Relying on long-term focus on market research and a strong risk control team, APAC Synergy and Kehlmann have jointly initiated property development creditor fund for China’s high net worth clients with strict due diligent service and solid returns.

Trust and Family Office

After three decades of reform and opening up, a large number of new wealthy families have emerged in China. With the business falls into stable stage, the entrepreneurial generation gradually enters into the elderly, the second generation’s heritage has become a hot topic, so how to break the curse of "rich but three generations" has become the most concerned matter. Kennedy family trust, Li Ka-shing family trust, Pan Shiyi family trust, Shaw Shifu family trust, and even one -third of the 200 Hong Kong public listed family companies have family trusts and that has proved that wealth inheritance and preservation through the establishment of family trust has become a historical trend.

Based on the successful experience of the world's top family offices, APAC Synergy would be able to design the corresponding family trust structure tailored to the need of the families to achieve wealth preservation and inheritance and create centenary family.